Understanding Credit Scores: What They Are and How They Work

A credit score is a numerical representation of a person’s creditworthiness, based on an analysis of their credit files. Typically, credit scores range from 300 to 850, with higher scores indicating lower risk for lenders. Credit scores play a vital role in personal finance, affecting one’s ability to secure loans, interest rates, and even rental agreements. They are calculated using various scoring models, with the FICO score and VantageScore being the most widely recognized.

The calculation of a credit score is influenced by several key factors. Payment history constitutes the most significant portion, accounting for approximately 35% of the score. This factor examines whether past due payments have been made on time, underscoring the importance of consistently meeting financial obligations. Following payment history, credit utilization plays a crucial role, comprising around 30% of the score. This metric considers the ratio of an individual’s current credit card balances to their total credit limits, indicating how well a person manages their available credit.

Additionally, the length of credit history contributes about 15% to the overall score. A longer credit history typically reflects more experience with managing credit, thereby potentially enhancing creditworthiness. The types of credit used, which include credit cards, mortgages, and installment loans, account for 10% of the score and can demonstrate a borrower’s ability to manage various forms of debt effectively. Lastly, recent inquiries into credit, which occur when a lender checks an individual’s credit score, can cause slight reductions in a score, marking the final 10% of the calculation.

Understanding these elements of credit scores is essential for individuals seeking to improve their financial standing. By managing payment history, credit utilization, and other factors judiciously, one can enhance their credit score over time, which is integral for favorable financial opportunities.

Common Myths about Credit Scores Debunked

Credit scores play a significant role in determining an individual’s financial health, yet several myths and misconceptions surrounding them persist. Understanding the truth behind these misconceptions is essential for making informed financial decisions. One prevalent myth is the belief that checking your own credit score negatively impacts it. This is false; when you check your own score, it is considered a “soft inquiry” and does not affect your credit rating. In fact, regularly monitoring your credit score can help you identify discrepancies and improve your financial literacy.

Another common misunderstanding is the notion that carrying a balance on your credit cards is advantageous for your credit score. Many individuals believe that maintaining a balance demonstrates responsible credit usage. However, this is misleading; credit scores typically benefit from low utilization rates. The ideal scenario is to pay off your credit card balances in full each month, as this not only keeps your utilization low but also avoids interest charges. Carrying a balance can lead to unnecessary debt and ultimately harm your score.

Furthermore, some people assume that only traditional loans, such as mortgages or car loans, influence credit scores. While these types of credit accounts certainly impact your score, they are not the only contributors. Credit cards, student loans, and even some forms of alternative credit, including utility bill payments, can also factor into your score. It is crucial to recognize that a diverse credit profile with a mix of credit types can positively influence your score.

Dispelling these myths about credit scores allows individuals to cultivate healthier financial habits. By understanding what actually impacts credit ratings, one can make more informed choices, ultimately leading to an improved credit score.

Strategies for Improving Your Credit Score

Improving your credit score is a vital step towards achieving financial wellness and accessing favorable borrowing options. Several actionable strategies can help you enhance your credit health effectively. One of the most critical factors is maintaining on-time payments for all your financial obligations. Late payments can severely impact your credit score. Setting up automated payments or reminders can assist you in staying consistent.

Another essential strategy involves reducing your credit card balances. Credit utilization, which is the ratio of your outstanding credit card balances to your total available credit, significantly affects your score. Aim to keep your utilization below 30%. Consider paying more than the minimum payment or making multiple payments each month to lower your balances quicker and positively influence your score.

Diversifying your credit accounts is also beneficial. Lenders prefer individuals who can manage various types of credit responsibly. If you only have credit cards, consider taking out a small personal loan or adding an installment loan to your credit mix. However, be cautious while doing so; only obtain credit when necessary and manageable.

Additionally, regularly reviewing your credit reports for inaccuracies is crucial. Mistakes can occur, and disputing erroneous entries gives you an opportunity to rectify your credit history, potentially leading to a higher score. You are entitled to one free credit report per year from each of the major credit bureaus, making it easier to stay informed.

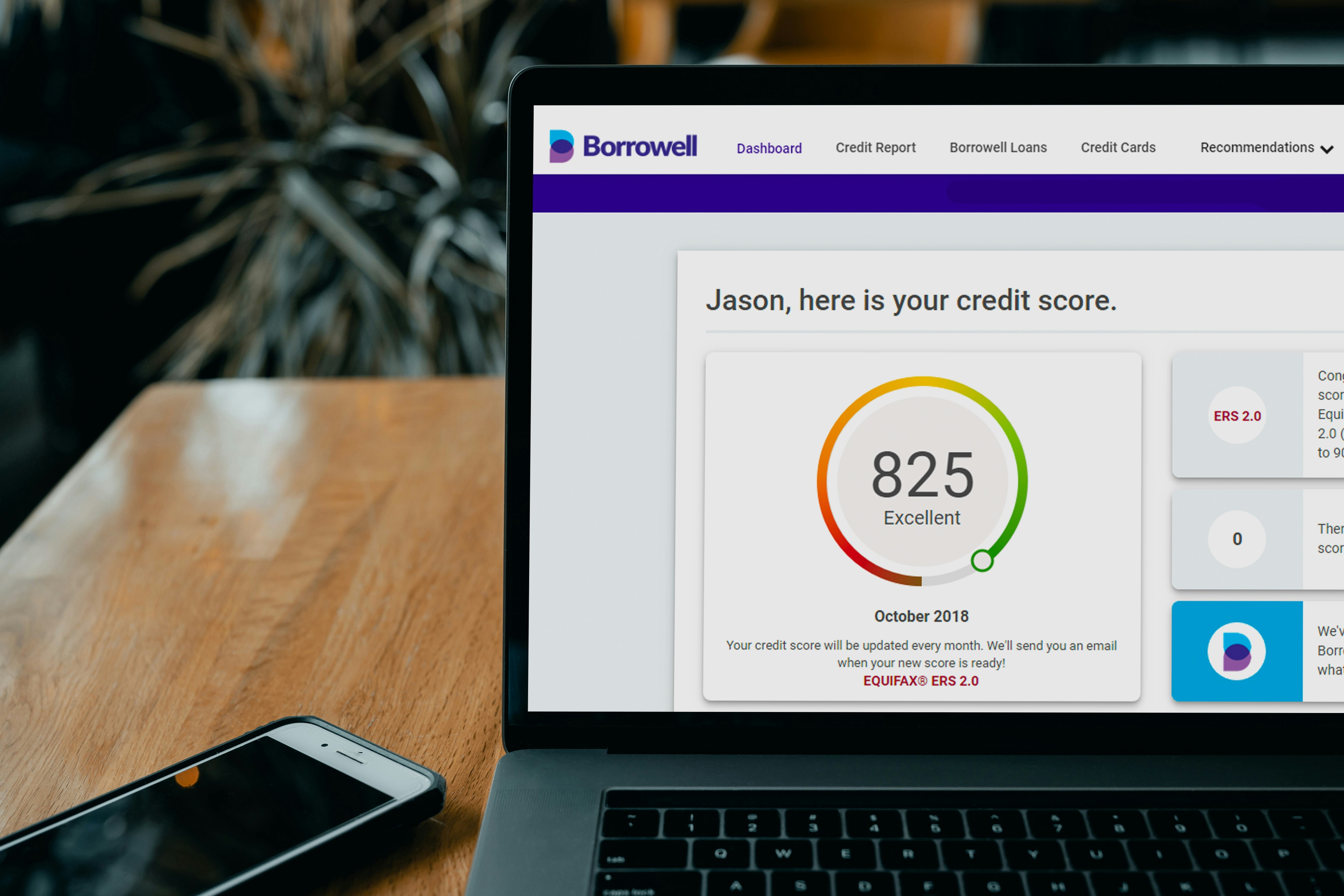

Finally, consider monitoring your credit scores through various financial services. Regular monitoring helps track your progress, identify trends, and allows you to make informed decisions about your financial health. By implementing these strategies, you can create a clear roadmap to improve your credit score and, ultimately, secure better financial opportunities.

The Long-Term Impact of Your Credit Score

The long-term impact of your credit score on your financial wellbeing cannot be overstated. A healthy credit score serves as a critical gauge of your creditworthiness, influencing various aspects of your financial life. One of the most notable effects is its role in loan approval rates. When applying for a home mortgage or an auto loan, a strong credit score increases the likelihood of receiving approval. Lenders view individuals with a high credit score as less risky, therefore they are more inclined to grant loans, ultimately paving the way for significant purchases that can enhance one’s quality of life.

In addition to loan approvals, your credit score directly affects the interest rates you are offered. Those with superior credit scores often benefit from lower interest rates, which can lead to substantial savings over time. This is particularly important when considering the long-term implications of borrowing; even a modest difference in interest rates can translate into thousands of dollars saved, especially on large loans such as mortgages. Lower interest rates not only reduce monthly payments but also lessen the overall financial burden associated with debts.

<pfurthermore, a="" additionally,="" and="" applying="" as="" assess="" auto="" can="" chances="" contributing="" credit="" determining="" enhancing="" factor="" financial="" for="" frequently="" good="" higher="" homeowners="" impact="" in="" insurance="" insurance.="" insurers="" landlords="" lower="" many="" of="" one's="" p="" part="" premiums,="" premiums.="" process.="" property.Thus, understanding your credit score as more than just a number is essential. It represents not only your current financial status but also your potential for future opportunities. Maintaining a good credit score is paramount for enjoying a healthy financial lifestyle and can lead to a wealth of benefits over time.